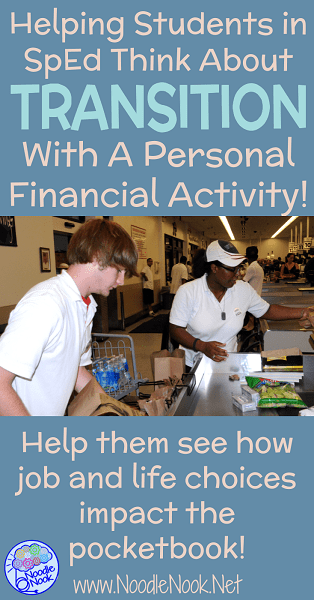

Read more about how a personal finance project for kids with disabilities (or any student for that matter) can help prepare them for future transition needs and also be a great part of vocational training and financial literacy!

Personal Finance Project for Kids!

This parent was no different. She had several things she wanted her son to work on as he started his last year in K-12. She wanted him to learn to work better with a budget. He needed to explore jobs he liked and better understanding living on minimum wage. She also wanted him to get the idea of moving into an apartment out of his head.

Whenever I have IEP meetings, I like to talk with parents first several weeks ahead. I do this for a couple of reasons. The biggest one is to speed up the meeting when it comes around. Talking for even fifteen minutes makes the meeting go smoother, guaranteed.

At my last parent pre-IEP phone call, I had an anxious mother. She was very worried about her son as he started to transition to post-secondary. He just wasn’t ready to graduate.

We talked for a bit about it. She was so worried about transition. This happens right before graduation and transition to post-secondary. Parents want lots of extra time dedicated to work skills, independent living and functional skills.

It’s okay to giggle a little at that.

Personal Finance for Milo

You have probably had a student like this, they think cars cost $200 and a pack of gum is $20. They think they will make a million dollars a year at a part time job. They think minimum wage will get them a Lambo, a whole house and tons of movie money.

Her son, let’s call him Milo, was this kind of kid.

She wanted to give him some real world context to ‘fix’ these things. Though I hate the idea of fixing, I did want to address her concerns. Plus I also wanted to expose my other students to the same type of practice.

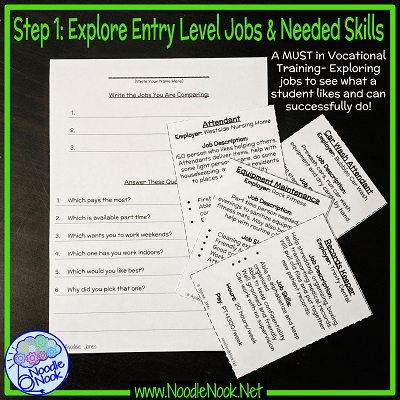

Realistic Job Exploration

I took some time to create several entry level job descriptions. This was to help Milo and my other students to do some basic job exploration. Part of this was making sure the jobs were things my kiddos may actually be able to do one day. Then I made a set of 28 job cards with jobs like Car Wash Attendant, Gym Equipment Cleaner, Summer Camp Cook, and Dental Office Helper. Then I added a comparison sheet to the activity so student’s had a way to compare more than one job.

Once they were created, I started using them to talk about money and comparing hours, job descriptions, and needed skills. I’d been wanting to beef up my vocational class activities. This part was super interesting. I got to see the jobs my students liked. I used the information to complete my student transition planning IEP documentation. This was exactly what Milo’s mom wanted, but I wanted to take it a step further.

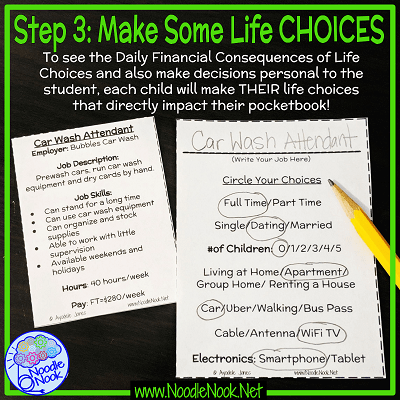

Making Life Choices

It was true for Milo and also for a bunch of my other students (and I think all teenagers)… They think just having a job will get them all the frills they want. Milo really thought he was going to have a brand new car, his own apartment, and a girlfriend working at Game Stop part time.

I think it is super important to explore several life choices with students. They need to see the financial impact of their decisions. I had a student who planned on being an OBGYN and having 5-6 kids, but she was nearly illiterate… college was not an option. How would she afford 6 kids? When it comes to seeing the impact of life choices, having a chance to make different choices, and seeing the new outcomes is an awesome experience to have with students.

When I started doing the personal finance project with my students, I would re-run it every month. Students picked different jobs, adjusted their choices and saw the outcomes on a recording sheet. It was cool to see how they would change their choices a few times.

Student Worksheets

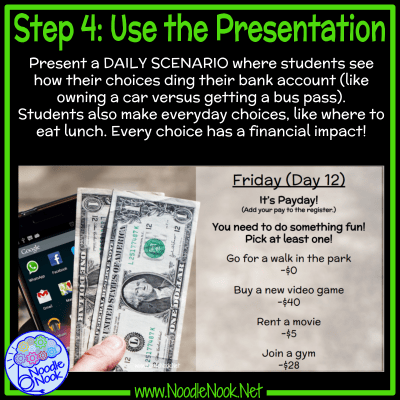

Every day for a warm up I put up a slide that showed the day, the event, and gave students choices for what they would do and how much it would cost. These are things like going to a movie and getting a snack. It includes what to pack for lunch… all those choices ding the wallet. Students can really see that on their balance sheets.

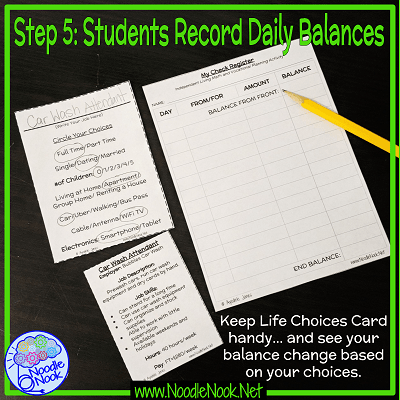

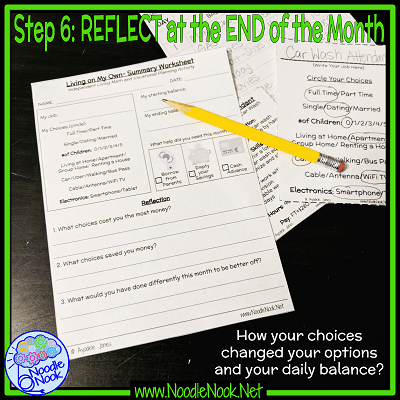

Putting what we are doing down in writing and reflecting also became a part of the monthly routine. I wanted students to look over what happened that month. What financial outcomes their choices made? Did they have to ask for help to get through a month of financial ups and downs. We did this after filling in the Balance Ledger/Check Register every day for a month.

Staying in the Black!

I swear, even my higher functioning kids always came out negative the first time out. They all see a little money in the bank and blow it on things they don’t need. Then, when real life happens, they’re totally unprepared. Most of the time, students have to borrow money. I gave them an option of borrowing from family, pulling from savings, and a payday loan. I wanted to be sure to include the loan as a way to offer some cautionary advice. When students took the loan, they have to pay it back with some hefty interest.

Rerun the Project Again!

This was another reason I reran this activity several times. It was perfect for learning life lessons in a contextual and ‘real’ way. In terms of making it work in the classroom, I used classroom folders and had students keep their materials there. We spent a few days on job exploration looking over the jobs and talking about what they might be like. Then we spent a day filling in our comparison and life choices sheets. All of this was in small groups (of course, don’t get me started). Finally, I presented it as their bell ringer work. Students read the daily presentation slide, made their choice, and wrote it on their balance sheet. We helped students as they needed it to make choices, write, or do math.

It Worked!

My students and I had a ton of fun. More importantly, we had success with this personal finance project so I had to share it. I was able to address Milo’s needs and his mom’s concerns. We talked about jobs, transition, and budgeting… and it was all super high interest and realistic. Now, Milo never learned that a Lambo wasn’t $200 and gum $20, but he was able to see some needed life choices (like living with mom). Either way, it was a great tool for transition planning, budgeting, and vocational exploration.

Financial Planning Features

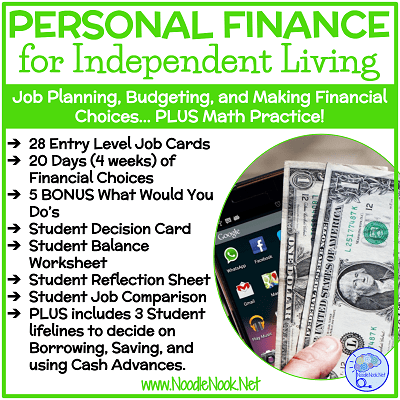

If you are like me, there are not enough hours in the day… I loved this product but it took me forever to put it together while working in the classroom. Save yourself the hassle. You can pick up the Personal Finance Project that already has everything prepped. It includes:

Student Materials

- Decision Cards

1 Card with 7 Significant life choices including marital status, housing options, transportation choices, and more. Students make life choices that will impact their monthly bills- every choice has financial consequences!

- 28 Entry Level Job Cards

Students will choose their jobs based on pay, full or part time job status, and job description. When the month is over, have students choose a different job! You can also expand this activity by doing some basic job exploration based on each job card!

- 3 Student Worksheets

- Student Check Register- To write down daily balances

- Student Reflection Sheet- Use at the end of the month to reflect on what happened, how much money is left, and what choices you’d make differently

- Job Comparison Sheet- Visual graphic organizer to compare two to three jobs and help students decide what they’d like to do

Presentation Materials

- 20 Days of Financial Choices

This PDF formatted for your projector or Interactive Whiteboard makes it the perfect postable warm up in your Vocational Training or Job Exploration class! With one a day, this personal finance project should last about a month. You can always repeat the month with new student jobs to last even longer. From where to get groceries to how to get to work, your choices matter! - 5 Bonus What Would You Do’s

Feel like throwing your students a curve ball? Here are 5 extra choices you can add in to test decision making, budgeting, and the pocketbook.

Bonus Materials

- Three Lifelines!

The Student Check Register and the Reflection Sheet have an option where students can use up to three lifelines: Borrow from Parents, Empty Your Savings, or Get a Cash Advance. At the end of the month, they have to make repayments. This is a great opportunity to talk to students about the impact of financial choices when it comes to borrowing.

How to Use It

I used this with ‘higher functioning’ students who had transition plans that included employment or volunteering. With students who were ‘lower functioning’ and did not include employment as part of their transition, I still urged them to participate by asking the daily questions and giving the student an option to choose. Then either I or an aide would write the outcome on their register. I still wanted them to be involved and included, but I think it works better with students who have employment transition plans.

Click here to purchase and be sure to pin and share this post. It is so important to have students think about their transition and what is possible and implausible.

How did this activity work for you? And how do you address vocational needs?

MORE TO LOVE!

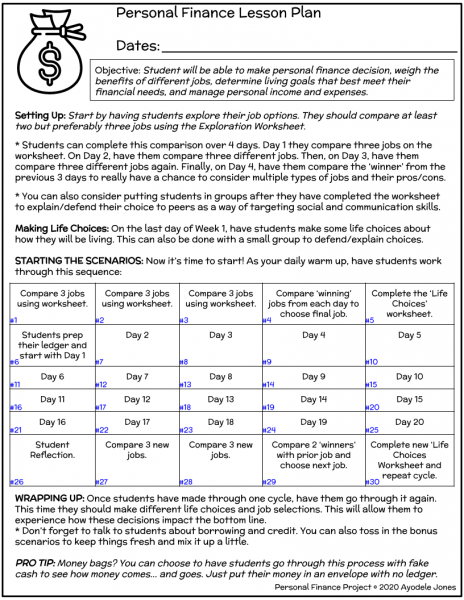

Updated in 2020: I just had a teacher reach out about a easy to digest lesson plan for this personal finance project. No problem! Click here or on the image below to download a PDF that will lay out the way I’ve used this resource and make it easy to see the progression all in one place!

This looks amazing. I’m the parent of a high functioning autistic young lady. She wasn’t diagnosed until 9th grade and was placed in a special classroom for kids like her. The teacher talked a good talk to others but did not follow the IEP consistently. She was very condescending and labeled my daughter as lazy and manipulative (although she was only struggling with communication issues, severe anxiety, sensory processing problems and executive functioning disorder). Other kids also had problems and one even attempted suicide out of anxiety – I found out later that the teacher convinced the parents that my daughter was responsible. Other kids were transferred to other schools or parents pulled them out to homeschool. The school system backed up the teacher because she was so good at manipulating/making it seem as though she was really trying and following the rules. There was a camera in the classroom but no audio. I heard what happened in class from my daughter recording part of a day and it was unbelievable. My daughterbroke and had to attend partial hospitalization in a mental health facility for suicidal thoughts. Twice within a year, even though she has a fear of dying (her father died when she was 10 following complications after open heart surgery). I pulled her out of school and she has been sporadically attending GED classes. Her anxiety has escalated to a level that is almost non-functional. She sleeps in my room now and needs to have me with her or nearby always. She lost insurance coverage when I became disabled and on Medicare. She had a very successful seasonal job at GameStop over Christmas, but cannot be hired until she gets her GED. She struggles focusing on schoolwork which brings back memories of the teacher that caused so much stress, anxiety and poor self esteem. She also lost the ability to continue therapy due to no insurance. Do you have any suggestions as to how I can get her help and progress in getting her GED? This program you setup looks amazing – can it be used at home? Thank you. My daughter will be 21 in November.

I am so sorry to hear you and your daughter have had so many challenges… and that you are having a hard time getting her what she deserves- a decent education. I am not a medical professional and have not met you or your daughter to be able to give any specific advice (necessary disclaimer), but I suggest you urge her to start making baby steps. As a child (or any person) gets more isolated and few demands are placed on them, the harder it is to get back into the swing of things. Set small goals for studying or GED testing and then make it a part of her everyday routine (even if it is studying for 10 minutes to start). Then add some vocational prep activities to prepare her in the home as you move to some volunteer work while she is not doing her seasonal job- at least then she will have some great work experience and references to get her a full time job wherever she chooses as well as offer her some ways to get out and socialize (so her social skills don’t get rusty and her anxiety around people doesn’t increase). Finally, look for social opportunities wherever possible, like with volunteering, heading out to the community center to participate in whatever is offered, or meeting up with social networks like those online.

Either way, build the social skills (and tamper down any social anxiety), work on vocational skills, and continue to prepare academically for the GED. As far as this activity goes, I do believe it will help with general independence skill building as well as offer you an opportunity to talk about her future as you work through it. Maybe that will provide some needed motivation, hope and engagement.

Also, if you are interested in having one of the Noodle Nook consultants talk with you, we do provide that service. I have someone who specializes in post-secondary transitions and helping families secure services after 22. Email me at ajones@noodlenook.net and I can start the process with you. Sometimes it helps to have someone who knows the ropes helping you out. Good Luck… and let me know how things progress for you. I will be thinking about you and your daughter.

Comments are closed.